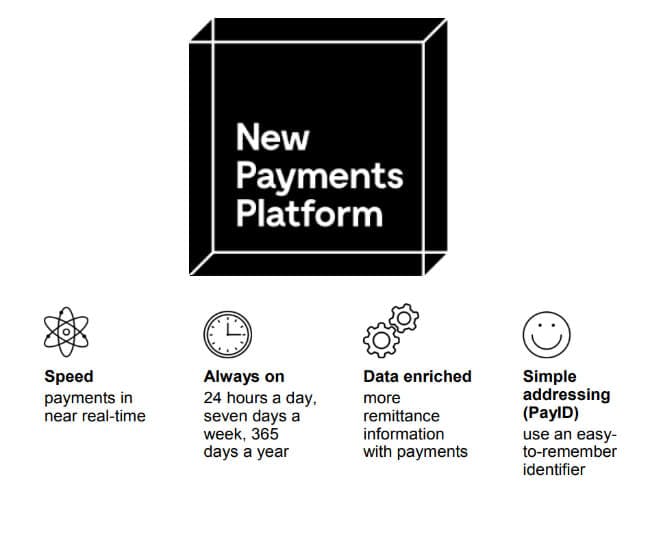

Unless you work in the banking industry, the chances are you haven’t heard much about the New Payment Platform (often referred to as the NPP). Yet, despite the current lack of hype, the NPP is set to have a profound impact on Australian consumers, businesses and governments by providing faster, simpler, smarter payments through a versatile data-rich payment system.

What does this mean?

Essentially, this means that you will be able to make secure payments in near real time, with close to immediate funds available to the recipient. It also means that you will be able to make and receive payments 24/7, outside of standard banking hours, and you will be able to do this using a service called Osko in your mobile or internet banking as well as a simple addressing service called PayID. PayID enables payments to be made to anyone more easily using mobile phone numbers, email addresses or ABN.

Why are banks implementing this payment platform?

In an era when many financial transactions are completed in seconds, it can still take up to five business days for the money to show up in someone’s bank account following a payment or funds transfer.

But contrary to common belief, banks don’t drag their heels transferring money to earn interest on it. Instead, they’ve been chained to mid-20th century technology that necessitates money leaving one financial institution, usually going to a clearing house, and then finally ending up at the other financial institution. All the parties involved must update their ledgers and make sure – during business hours – they are not sending or receiving more or less money than they should.

Banks around the world have long been aware of the increasing untenability of the traditional way of processing payments. This is especially relevant with a growing digital economy, where everyone from business owners to gig-economy workers are confronting cash flow issues arising from payment delays.

In recent years, countries such as the UK and Singapore have introduced systems that allow real-time transactions to happen 24/7, 365 days a year. China, Chile, Japan, Mexico, Poland, South Africa and Switzerland have also switched to platforms that allow real-time payments in some shape or form.

What is the story behind the NPP, where did it come from?

The history

In 2012, a strategic review of the Australian payments system by the Reserve Bank of Australia’s Payments System Board identified the need for Australia to adopt a more competitive and commercially orientated payment scheme as seen around the world.

In its paper titled ‘Real Time Payment Committee Proposal,’ the Reserve Bank of Australia (RBA) essentially called on Australian financial institutions to get the ball rolling on a real-time payment system.

The industry then consulted on the creation and implementation of a new system, which came to be called the New Payment Platform. Every bank, building society or credit union wanting access to the NPP then had to go through the process of designing, developing and testing new technology so they could migrate to the new system and continue to ensure the safety of their customers in doing so.

The future

Six years on, the robust build and testing process will be complete. Regional Australia bank, unlike some of its competitors and big 4 banks, will be providing its customers with access to the NPP from the first day it comes into operation.

Along with facilitating fast payments and data-rich transactions (payment descriptions will go from 16 characters to 280), the NPP opens lots of exciting opportunities for Australians and Australia including:

- The opportunity to move to a cash and cheque free economy.

- Less reliance on credit cards for major purchases where instant payment is required.

- The opportunity to build products or services on top of the NPP’s layered architecture design.

- Additional ‘Overlay services’ similar to Osko that enable real-time payments to be made for example an overlay services that could allow consumers to convert loyalty points to cash at the point of sale or allow governments to rapidly deposit money in citizen’s bank accounts in the event of a natural disaster or individual hardship.