Why the change

The Australian Government has passed new legislation that will change the way we calculate interest on purchases for personal credit cards from 1 January 2019.

Who does this effect?

These changes affect all Regional Australia Bank credit card facilities.

Changes to how interest is calculated on purchases

Regional Australia Bank credit cards have an interest free period;

- Up to 55 days for a Your Choice Visa,

- Up to 45 days for a Platinum Rewards Credit Card.

Prior to the 1st January 2019, if you didn’t make the full repayment by the due date on your statement interest would then be charged from the date of the purchase.

After the 1st January 2019, if you don’t make the full repayment by the due date on your statement interest will be charged from the payment due date.

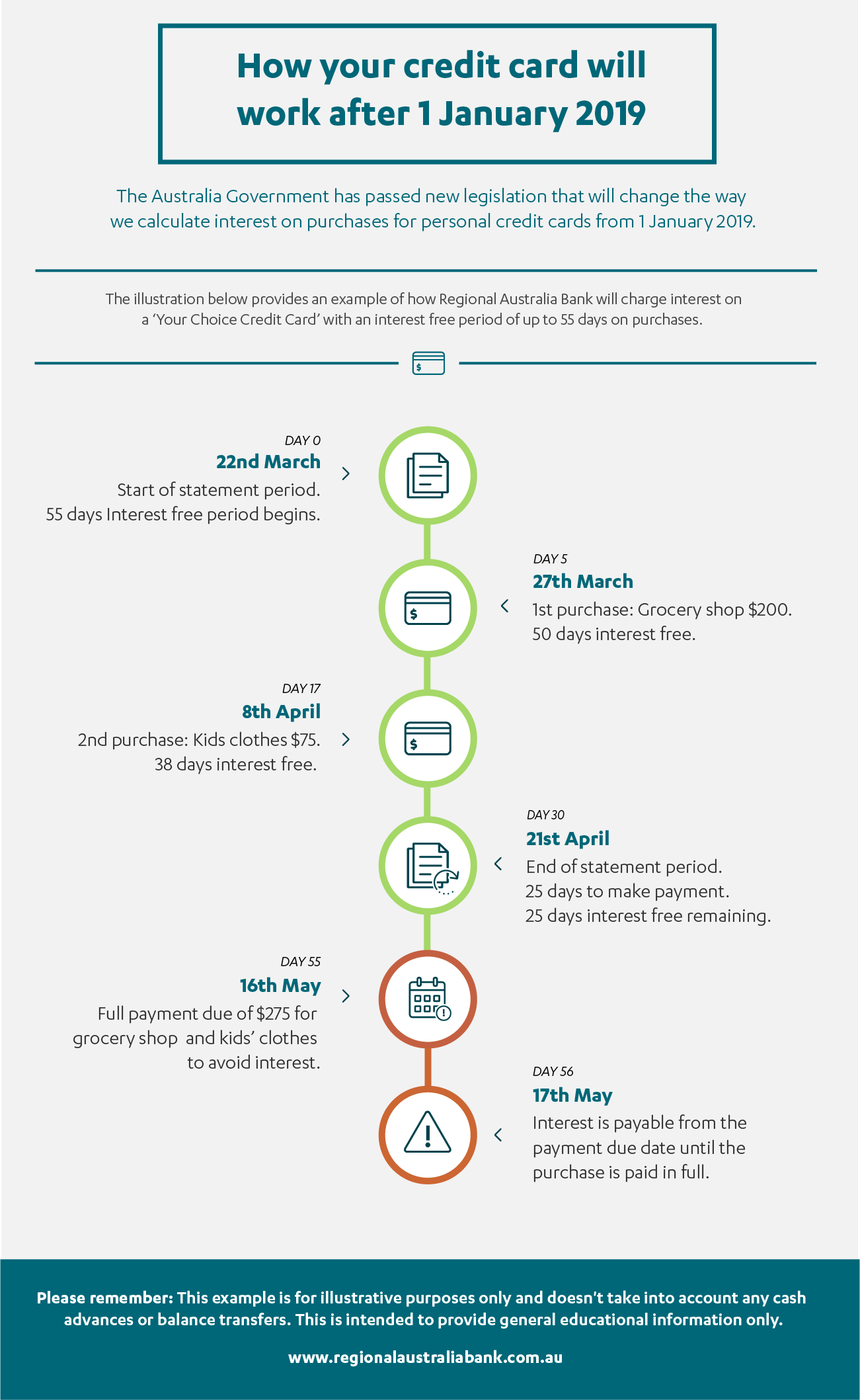

As illustrated below, you will be charged interest on your credit card purchase from the payment due date after 1 January 2019.

Please note, the interest-free period is not available for Cash Advances, Transfers or BPay transactions.

How does this affect you?

From 1 January 2019 if you;

- Pay your credit card in full each month, and you will not be affected.

- Make the minimum repayment each month then generally you will pay lower interest.

Credit Limit Reduction & Cancellation

Another important change is that you will be able to request a reduction to your credit card limit or cancel your credit card limit online via our website.

More Information

Accordingly, we have updated our Visa Conditions of Use which can be viewed on our website after 1 January 2019.

The sections of our Visa Conditions of Use that will change on 1 January 2019 are:

- Part B, Section 2.0 – Definitions / Restricted Interest-Free Part B

- Section 14.2 - Interest

- Section 6.6 – Credit Limit.

After the 1st January 2019 to view or download a copy of these updated Visa Conditions of Use here: https://www.regionalaustraliabank.com.au/about-us/corporate-documents/product-terms-and-conditions

.png?auto=format&w={width})

.jpg?auto=format&w={width})